Complete guide to billing and payments for child care centers

Managing billing and payments for child care centers is an important aspect of running day-to-day operations for a child care center. Many preschool owners open their centers with a focus on day-to-day operations: activity schedules, meal plans, teacher scheduling, and the list goes on. While all of these items are dealt with, billing and collecting payments still need attention as an essential operational need for the business!

A lack of focus on such critical aspects of running a child care business sets owners down a slippery slope of accepting dozens of forms of payment, a lack of financial tracking, and late or missed payments from families.

In this article, we review how to properly manage billing and payments for child care centers. Chances are that you are probably already doing most of the things on this list, but pay close to attention to the ways you are doing them. Follow these best business practices to make sure you are truly providing the best experience for the families, staff and children in your care.

Disclaimer: Before making any big changes to your business finances, it’s always best to consult with your accountant or financial advisor.

Setting Your Rates

Establishing how much to charge for your services is one of the most difficult parts of any business. What often happens is that daycare centers and families may not see eye-to-eye on tuition/child care costs and the return of value. You want to charge high while your families want to pay low. Even if you are not entirely motivated by making a profit, you would still need to ensure that you charge enough to cover all of your operating expenses, while earning enough income to make all of your hard work worthwhile.

To determine a fair enrollment cost, first add up everything it will cost to operate your business. Do you have staff to pay? Rent? Class supplies? Insurance? What about your own salary? By totalling how much it costs to operate your business, you’ll have a clearer understanding of what you’ll need to at least stay afloat, and thereafter, how to set childcare tuition rates. Also, don’t forget about taxes!

It is just as important to understand how much other childcares in your area are charging. Families will be comparing prices, so it’s important to be within the same range as what other centers cost (or if you charge more, you need to be prepared to convey why the extra costs are justified). Also note that some subsidy programs have a cap on what centers can charge for a subsidized spot. Taking this into consideration, ensure you are aware of how many of these spots you’re able to offer, or if the entire center is subsidized, it’s important to know the rate cap in your area. Get a head start by looking at the competition: check websites and child care resources for nearby centers to see if they list their pricing. If not, you can even go undercover as a family member, and call to ask for pricing information. Another thing to note is that all rates must be published in your parent hand books, so don’t forget to ensure you’re following the necessary guidelines to keep your regulation needs up to date!

Bookkeeping

If it’s tax time, and all you’ve kept track of is where your 17 loose piles of invoices, receipts and cash are, then it’s likely you won’t be in for a good time. If you don’t even have receipts or invoices in the first place, it can lead to even more tedious work and risks of errors that are difficult to trace.

To keep on top of child care payments and billing, it is crucial for you to have a good handle on your numbers. Whether it is through a simple spreadsheet or a child care app, maintaining an up-to-date record of family billing and the statuses of their payments to enable you to know who owes what, at any given time.

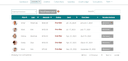

Lillio invoice page – invoices in overdue status

While bookkeeping can be done in a paper ledger, nowadays keeping digital records can be much easier and safer. Unlike paper, information stored digitally is much less likely to be lost. It is also easier to search through this information, and instantly pull reports that can assist you.

Invoices & Billing

To collect payments from families, you’ll first need to ensure that you have a proper invoicing and billing process in place. While some childcare centers refrain from doing any billing because ‘the families know what to pay, and when to pay it’, this isn’t always the best idea. Centers need records in case of audits, and to help with end-of-the-year bookkeeping. Families are complex, and having a system that supports family complexities is key, so using a system that can split invoices between family members is an additional benefit when it comes to invoicing.

To avoid headaches later on, make sure that your invoices are detailed and accurate; that way you can prevent issues that you will need to investigate and fix. Your future self will thank you!

While invoices may remain the same each billing cycle, some childcare providers may prefer attendance-based billing, for whom it’s even more critical that they have accurate records. Other contributing factors to changing invoice totals may include extra child care services, supplies, field trips and other à la carte items that need to be accounted for. Before sending out your invoices, go through your relevant records (which you did if you were following along earlier in the article!) and update accordingly — or better yet, add these items as they come up. That way, all you have to do at the end of the month is press ‘send’.

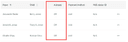

Adding line items for added charges in Lillio

As for the format you send your invoices in, email is a great option, as it’s less likely to get lost. It is also one of the quickest ways to get them over to families, which will help them send your payments sooner. Digital options like email will make it easier to send reminders, or re-send invoices in cases where families cannot find them, and in-app reminders are even better! A reliable childcare management system will reflect invoices within the platform and make it easier to monitor the ones you have sent.

Accepting Payments

Many child care centers try to be as accommodating as possible, and so they will accept numerous forms of payment options or offer alternative payment programs. Unfortunately, the more forms of payment you accept, the more cumbersome things can become administratively. When you willingly accept any method of payment such as bank account transfers, credit cards, debits, check, cash and buckets of quarters, knowing how much money you have at any given time can be difficult to track. Additionally, third-party cash apps lack buyer protections such as the ability to dispute credit card charges, and worse off, they can be prone to fraudsters.

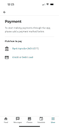

Monitoring payment methods added for each parent in Lillio

When possible, electronic payments are the easiest option for both families and administrators, since no trips to the bank will be needed for withdrawing or depositing funds, nor will families need to physically submit payments with an office administrator during those busy drop-off and pick-up times. When families pay via payment processing within a childcare management system, invoice statuses are updated automatically, saving administrators time, and letting families have real-time insights into the status of their payment. While there are typically small processing fees involved with electronic payments, many centers consider the amount of time and manual work saved as money well-spent, as they would no longer need to track multiple payment forms.

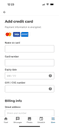

Parent view of parent payment method entry in Lillio

Chasing Payments

Whether intentional or not, late payments are a fact of life at any child care center. Centers may want to implement mandatory autopay or pre authorized debit, which should be reflected in their parent handbook. When you combine busy families of active toddlers with educators who spend all day with those same children, it’s not exactly the easiest recipe for smooth invoicing and getting paid on time

Getting paid in a timely manner is crucial for keeping your business running smoothly, so it is very important to have a system in place that ensures you never miss a payment. It’s often an advantage for the allowance of paying multiple invoices with one payment where applicable.

As payment due dates approach, centers may proactively remind parents that payments are to be submitted soon. They may even opt to create and send invoices well ahead of the due dates as a way of providing parents with a buffer. You can always resend an invoice, or accept partial payments in instances where that added accommodation is needed. Lillio’s system will automatically send email reminders when an invoice is overdue.

Similar to credit cards and banks, establishing and outlining the consequences for missing a payment will also help enforce families to stick to your schedule. If you don’t have a policy around penalties for late payments consider updating your family handbook or center policy documents to include detailed information on penalty charges or conditions. Be sure you send invoices with plenty of time to allow parents to submit a payment, that way, families have a fair chance to pay their balance before incurring any penalties. Learn more about how to chase payments at your child care center.

Example of creating an invoice for a late fee

Paying Staff

When it comes to managing the finances of your childcare, paying your staff should be one of your first priorities. After all, with no staff, you won’t have anyone to care for the children, thus leading to reducing your enrollment capacities which is never ideal

There are many payroll software solutions out there to choose from, and which one you choose will depend on your needs and preferences. If you operate a small child care center (or family child care home-based business) and are doing this yourself, look for options that provide great customer support on a schedule that works best for you. Staff management is top-of-mind when thinking about paying staff; high-quality management will allow centers to keep track of staff hours easily alongside payroll software.

Similar to what we covered with families, avoiding special exceptions and multiple forms of payment will make things easier for you in the long run. Stick to a regular pay schedule, and avoid cash or manual payments. As you may have guessed, going paperless as much as possible is ideal, which is why centers often opt for direct deposit as a standard business practice. It’s also important to be aware of schedules between paying staff and when parents pay tuition; be sure not to set due dates on the same day as payroll and give yourself enough buffer and time so that these payments are not competing for time.

Expenses

As they say, you have to spend money to make money. Whether it’s teaching supplies, cleaning products, or snacks, there are many expenses that go into running a high-quality child care center.

As with everything else nowadays, there are many software solutions out there designed to manage business expenses. One advantage of choosing expense tracking software is that you can specify categories for what each expense is for, and then easily notice trends over time to identify areas you are spending too much on. You can also attach screenshots of your receipts (and in some cases, automatically extract all receipt information so that you don’t have to type anything), which will make it easier to keep a record of all of your documentation. This type of tracking comes in handy alongside your childcare tuition revenue reports, as it helps you to cross-reference and manage your finances.

Taxes

Even though it happens at the same time every year, tax season always has a way of sneaking up on all of us. Nothing is worse than having to backtrack and figure out your numbers as a result of disorganized bookkeeping… except for owing a large amount that you weren’t expecting!

While most child care centers are exempt from having to collect sales tax, those which are not can benefit from a simple process. On each invoice, you can simply add the sales tax This not only ensures you collect the required amount, but also makes it easier to recall these numbers later when it’s time to file your taxes.

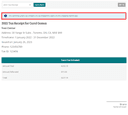

By keeping detailed invoices, you can also make things easier for the families come tax season. You can make tax receipts available to all families with eligibility in just one click! Plus, families can see a record of all of their invoices at any time, so there would be no need to send statements each month!

Families can get easy access to their tax receipts in Lillio families

As you can see, by digitizing your record-keeping and keeping everything in as few locations as possible, it is easy to slice and dice information in order to get the numbers you need quickly and efficiently.

No matter what type of child care center you run, at the end of the day it’s a business. Keeping a good handle on your finances is critical in order to be able to continue doing the important transitional work of improving childrens’ lives and supporting their families. With all of the work that goes into being a child care provider, making billing and payments simpler will save you a lot of tedious work in the long run, and it will lead to families raving about how easy you make it for them!

In addition to digital invoices and the ease-of-use for submitting payments,Lillio also creates a great experience for families by communicating all of their child’s development in your child care programs. Families can see what happened each day, and track their progress over time. To learn more about how Lillio can provide the child care assistance you need, book a demo today!

Note: this article was originally published January 28, 2019 and updated with revised content September 25, 2024.

Related Posts

Michael writes for HiMama's early childhood education blog and ECE Weekly newsletter. When not developing content for early childhood professionals, he can usually be found out and about with his wife and daughter exploring all that Toronto has to offer, or playing music with his karaoke band.

More by Michael

Michael Keshen

September 26th, 2024

22 mins

Related Articles

The Benefits of Loose Parts Play for Young Children

December 10th, 2025 | Maddie Hutchison